The physician’s enterprise mentioned it had entered into an settlement to Proasurance Corp. for $ 1.3 billion, which takes the corporate personal.

Birmingham, Alabama headquarters Proassurance is a specialty insurer with experience in medical accountability, merchandise answerable for medical know-how and life sciences, and employee compensation insurance coverage. The Medical doctors Co. Van Napa, California, is the most important medical malpractice insurer within the nation.

The transaction is predicted to shut within the first half of 2026. Upon completion, the standard share of Proassurance will not be listed on the New York Inventory Alternate, and Proasurance might be a completely owned subsidiary of the Medical doctors Co. , which creates a joint firm with belongings of roughly $ 12 billion.

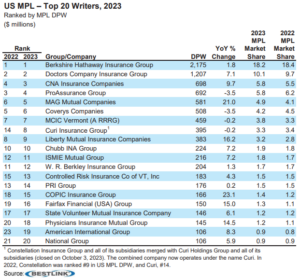

The score company AM Greatest mentioned the Medical doctors Firm Insurance coverage Group is the second largest writer of Medical Skilled Legal responsibility (MPL) insurance coverage within the US primarily based on 2023 direct premiums written (Am Greatest mentioned it’s gathering 2024 knowledge). Proassurance is the fourth largest. Berkshire Hathaway is first with greater than 18% market share. Along with Proasurance, Medical doctors Co. have nearly 16% of the MPL market.

I used to be greatest added that it doesn’t anticipate the transaction to have an effect on the monetary power score of an (glorious) for the Medical doctors Co.

When it comes to the settlement, shareholders of the Professional insurance coverage will obtain $ 25.00 money per share, which is a few 60% premium for the closing value per share of Proasurance Widespread Inventory on March 18, the final buying and selling day previous to the announcement of the March 19.

The Board of Administrators of Professional insurance coverage unanimously accredited the settlement and would suggest that shareholders do the identical.

“Healthcare is a group sport, and the groups are getting larger. To offer them with the most effective possible service is a mission-based firm with nationwide scale, assets and dedication to all medical professions and healthcare suppliers,” Richard E. Anderson, chairman and CEO of the Medical doctors Co., mentioned in an announcement. “The addition of Professional insurance coverage to the Medical doctors Co. Will increase our means to serve healthcare employees now and sooner or later.”

“Each Proasurance and the Medical doctors Co. have been based by docs in response to the Seventies medical legal responsibility disaster,” in accordance with Ned Rand, Proassurance’s president and CEO.

“This shared historical past has helped each companies fulfill our shared mission to guard others and provides us related operational philosophies and cultures,” he added. “If we carry collectively the strengths and skills of our companies now, our groups can proceed to serve at the moment’s healthcare suppliers with the mandatory scale and breadth of talents.”

In a report on the MPL market printed 2024, AM Greatest mentioned that insurers on this enterprise nonetheless face lots of the identical challenges because the previous few years-an growing frequency of excessive severity losses, pushed by social inflation elements, in addition to employees shortages, progress in various care amenities, and a erosion of reform in some jurisdictions.

Matters

Carriers

Are involved in Carriers?

Get automated warnings for this subject.

(Tagstotranslate) Enterprise Strikes & Mergers (T) Medical Malpractice Insurance coverage (T) Proassurance Corp. (T) The Medical doctors Co.

==================================================

AI GLOBAL INSURANCE UPDATES AND INFORMATION

AIGLOBALINSURANCE.COM

SUBSCRIBE FOR UPDATES!