On this collection of blogs, my colleagues and I’ll take a look at the insurance coverage sector in development markets, with a selected concentrate on expertise, digitization, platforms, and ecosystems.

Life and P&C insurers share comparable drivers of their have to modernize core methods. In spite of everything, they face most of the identical challenges, together with digitization, the rise of platform opponents, altering buyer expectations, and the necessity for online service.

Nonetheless, life insurers face distinctive challenges relating to modernizing core platforms. Because of this, their decisions are extra complicated, whereas the methods by which they will implement the mandatory adjustments additionally differ.

Was in paper and outdated code

Variations largely stem from the time issue: life insurers’ merchandise cowl for much longer intervals—for instance, a long time for retirement merchandise versus a year for automotive insurance coverage. As well, merchandise usually tends to be saved on legacy methods. And there are totally different guidelines for various merchandise, which complicates any answer.

Furthermore, even when the insurer is aware of the product guidelines, migrating insurance policies to a brand new system is a fancy and dangerous train. A few of my purchasers maintain tens of millions of insurance policies. Extracting it from outdated methods and shifting it to a brand new one that has a really strict set of knowledge guidelines is a logistical nightmare. And in contrast to P&C insurers, there are only a few compelling off-the-shelf software program options, though Accenture’s Life Insurance Coverage Platform (ALIP) is an exception to that rule.

The complexity will increase as a result of life insurers wanting to resolve information conversion. It is a problem as a result of the outdated methods’ information guidelines are usually lengthy forgotten, whereas any consultants who keep them are nearing retirement.

This explains why many life insurers haven’t acted. It isn’t that they do not need to; in any case, no CIO desires to be chargeable for a dozen inefficient methods that might be costly, run poorly, and are written in a language that few folks can keep. It’s because it isn’t simple to behave. If it was, life insurers would have completed it years in the past.

Many life insurers are due to this fact in an identical place: working quite a few separate methods at excessive price and with restricted effectivity. Unable to emigrate insurance policies from outdated methods, they merely assumed they needed to hold everybody operating. For instance, one shopper in France had 17 separate dwelling methods.

The disconnecting lifeline

There are 4 methods open to life insurers trying to change their core methods, with the most suitable choice depending on provider technique, expertise stacks, and product varieties. Let’s take a look at the primary three:

- Change: it often includes the usage of a cloud-based platform and SaaS and is best fitted to commonplace product varieties in massive geographies. As talked about above, one basic problem is the conversion of outdated insurance policies.

- Re-platform: the outdated core platform is transferred from mainframes to the cloud, with conversion factories changing COBOL to Java, for instance. In apply, nevertheless, a poorly developed implementation in COBOL turns into a poorly developed implementation in Java, which implies it doesn’t present flexibility and the necessity for a real digital structure.

- Retire: features of the system are put into shutdown mode and core capabilities are decreased. That is often not of a lot use to life insurers.

It’s at this level that life insurance coverage purchasers usually ask: Effectively, what can we do?

The reply is to rebuild. This includes the digital disconnection and hollowing out of the core. I’ll go into way more elements on this matter in an upcoming weblog collection; however, briefly, this method sees the insurer develop a technique that regularly replaces the system’s capabilities and reduces the scope of the purposes used. This brings flexibility, improved time to market and higher journeys for digital distributors and buyer journeys.

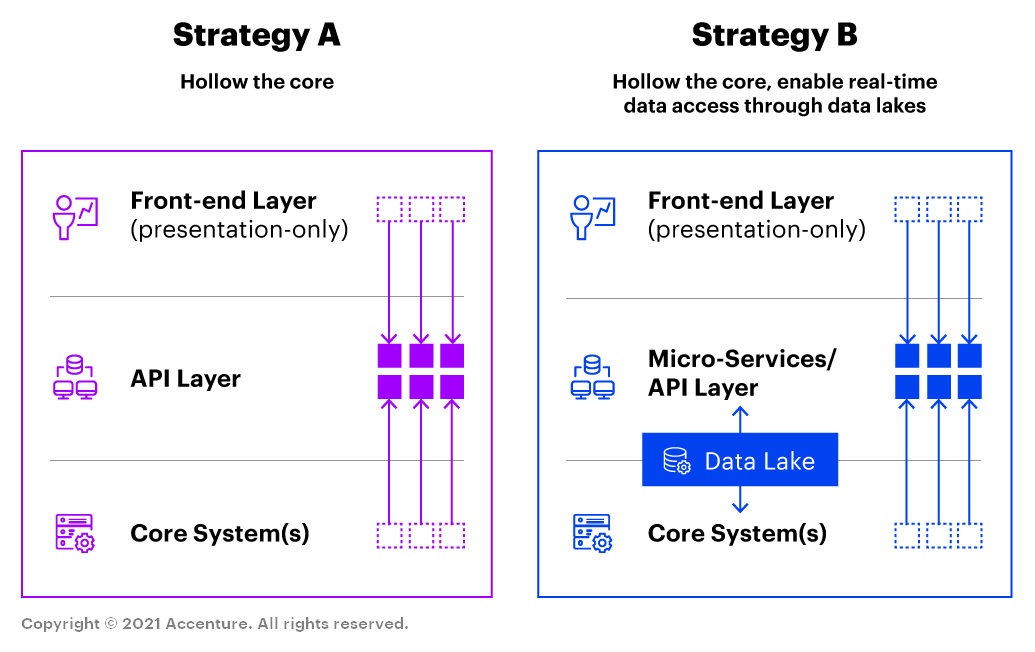

Because the diagram reveals, life insurers have just a few choices relating to defining the appropriate decoupling technique. In each circumstance, they take away enterprise guidelines from front-end and back-end methods to keep away from duplication and hole out the core of the legacy system by utilizing APIs and microservices to run processes. Technique B differs by incorporating real-time entry into an information lake to make sure fast updating and processing.

(It is worth mentioning {that a} decoupling method is often much less relevant to P&C insurers, as a result of their merchandise have a brief timeline; they usually can simply select from quite a few alternative software program choices.)

For all insurers coping with multi-year merchandise and an absence of software program alternate options, decoupling is usually one of the best methods—as certainly one of my purchasers in Asia discovered. This buyer had a number of group life methods and extremely complicated insurance policies, and it was unable to course of information in actual time.

We helped the shopper regularly implement a decoupling technique throughout every nation in which it operates. Crucially, this meant altering the corporation’s tradition in order that it may implement agile improvement methodologies. This ensured that native operations in every nation may go their very own manner; however, they nonetheless operated beneath the decoupling template.

At present, this shopper has an extremely environment-friendly system that quickly develops new merchandise and updates info for purchasers and operations in actual time. (The backend system is up to date on a delayed foundation; however, this has no impression on what the shopper sees or on the insurer’s operations.) With this in place, it might leverage its agility and digital structure throughout all its markets, which places it far ahead of the competitors.

Having a responsive, digital platform places each life and P&C insurer in a wonderful place to hunt companions and develop their buyer base. As we are going to see in my subsequent blog, partnership brings each alternative and challenges.

==================================================

AI GLOBAL INSURANCE UPDATES AND INFORMATION

AIGLOBALINSURANCE.COM

Subscribe for updates!