It took a worldwide pandemic to speed up digital transformation within the life and annuity trade. COVID-19 has induced main modifications in the best way we stay and work, driving customers of all ages and digital talents online, whether or not they prefer it or not.

However, the pandemic isn’t the only driver of change within the trade. Client habits have already modified, and analysis reveals a profound shift in their values, which are actually extra centered on well-being, security, and monetary safety.

These circumstances have converged to present life and annuity carriers with a singular alternative to reinventing their digital insurance coverage companies. Customers now function within the digital area greater than ever, so carriers should meet them there. They might want to use wealthy knowledge and digital applied sciences to supply quick and straightforward online transactions, new and improved services, and improved product distribution and companies. They might want to transfer from a transactional enterprise mannequin to a relationship mannequin that cultivates precious and lasting relationships.

This digital shift amongst customers is right here to remain. Youthful generations, who’re typically extra digitally savvy and accepting of the know-how of their day-to-day lives, made the shift earlier than the pandemic. Whereas retention charges throughout the trade proceed to hover around 85 p.c., our analysis reveals that extra Millennials and youthful customers say they plan to modify insurers within the subsequent 12 months. Their adoption of, and desire for, digital channels makes it simpler for them to resolve to modify to digital insurance coverage rivals, together with new insurtech entrants.

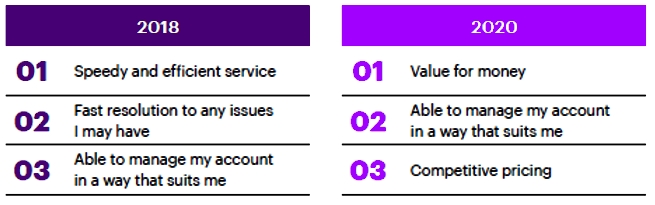

Accenture Analysis reveals customers count on extra for his or her cash and need to be in command of their info. Three ways COVID-19 is changing insurance, Accenture 2020

Determine what the buyer wants; give them what they need

Below the previous method of doing enterprise, it might be tough, if not unimaginable, to satisfy the brand new calls for digital insurance coverage customers. Conventional demographic knowledge merely couldn’t present the insights wanted to create new insurance coverage merchandise particular to their desires and wishes. However, in this new digital reality, insurers can accumulate huge quantities of information by no means earlier than accessible to them by the Web of Issues, equivalent to health monitoring units. Customers additionally point out a willingness to commerce private knowledge for extra customized services. This immense quantity of information, when processed by synthetic intelligence, can present the clearest and most detailed profiles of customers ever.

Accenture surveyed practically 50,000 customers throughout 28 world markets. Our analysis discovered that millennial and youthful customers aged 18–34 expressed better curiosity in digital choices that assist them in making safer, more healthy, and more sustainable decisions. And practically 60 percent of customers over 55 stated they might share vital knowledge for private companies that assist them in stopping damage and loss, a rise of 24 percent from two years in the past.

Main insurers are leveraging this buyer knowledge and investing in greater digital buyer expertise to distinguish themselves and win shopper belief and loyalty. Moreover, our analysis reveals that digital investments repay in income development, with leaders seeing 13 percent extra premium and annuity income than their friends (Supply: Where is the payback on digital innovation in insurance?).

Information insurance coverage clients to security and wellness—Insurance coverage Client Research 2021

Going ahead, profitable insurers will use digital applied sciences to create a 360-degree view of their clients. They’ll meet in a digital insurance coverage market deeply knowledgeable by wealthy knowledge and powered by synthetic intelligence, which identifies the particular person the buyer wants at a granular degree and offers services tailor-made particularly to them.

The brand new digital buyer expertise will go far past the digitization of paper varieties. It will likely be a very new course with automation to enhance consumption and proof assortment. It is going to use predictive danger fashions to allow liquid-free underwriting, shortening declare selections to hours as a substitute of weeks or months. It is going to use video to welcome new policyholders with the identical heat and personalization of a face-to-face assembly.

Good for customers, good for enterprise

Digital capabilities mixed with knowledge analytics will assist your organization to domesticate wholesome, long-term buyer relationships, probably rising lifetime buyer worth and alternatives by related affords. Whether or not your digital technique is to construct or purchase differentiating capabilities, at this time’s cloud-based digital insurance platforms afford the flexibility to do each. In consequence, insurers not solely enhance long-term buyer expertise and enhance lifetime worth, but in addition cut back short-term working prices. Learn the way buyer expertise can differentiate your insurance coverage enterprise and drive worthwhile new alternatives. Let’s have a dialog.

==================================================

AI GLOBAL INSURANCE UPDATES AND INFORMATION

AIGLOBALINSURANCE.COM

Subscribe for updates!