Federal Reserve: Auto Mortgage Mortgage Balances is growing by $ 11 billion within the third quarter

Per

on

Announcements | Market trends

Family debt rose by $ 93 million and reached $ 18.4 trillion, whereas the automotive mortgage balances elevated by $ 11 billion to $ 1.66 billion throughout the fourth quarter 2024, According to the Federal Reserve Bank of New York.

Yahoo Finance stories that $ 18.4 trillion is a brand new spotlight principally brought on by the inflatable of bank card balances that rose by about 4% to a file $ 1.21 trillion.

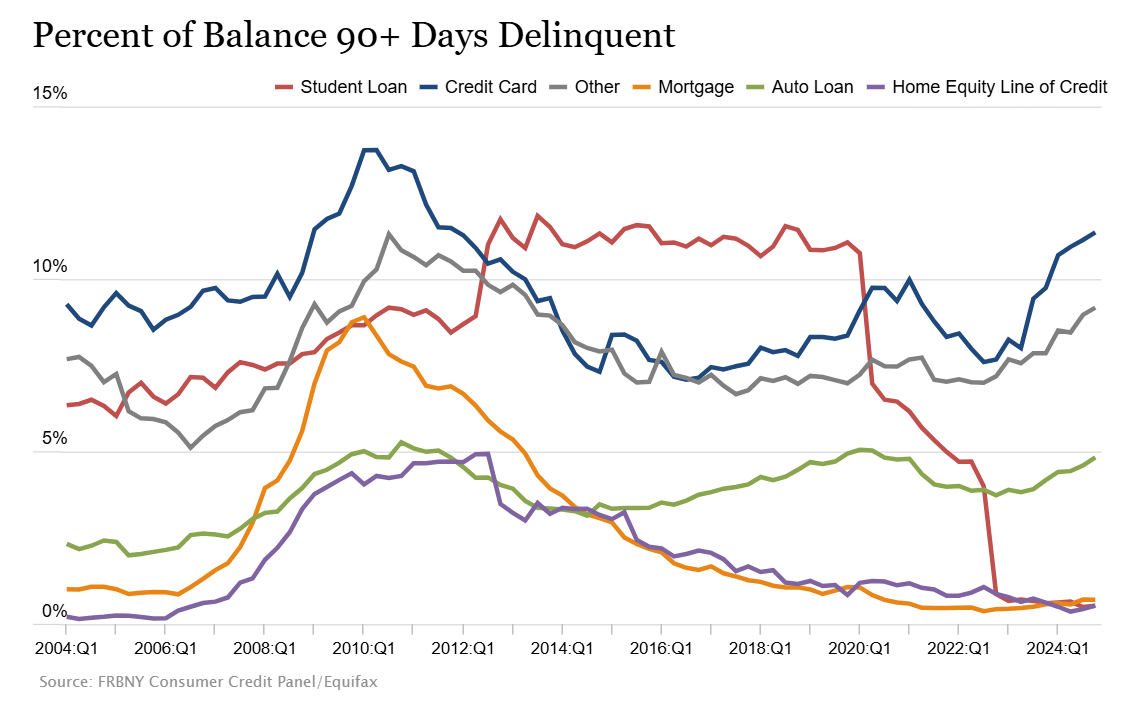

A extra trajectory is the intense delinquency charges, particularly for automotive loans and bank cards, the article says.

In line with the Federal Reserve, 4.8% of automotive loans had been 90 days or extra legal within the third quarter. That was greater than 4.2% within the fourth quarter of 2023. The delinquency of 90 days or longer was 11.4% within the third quarter.

“I actually see {that a} development of funds for automotive loans could be very excessive and causes loads of stress about how folks pay for dwelling bills and (their) growing reliance on credit score,” Victor Russell, Operations Supervisor of Apprisen, didn’t -gain credit score counseling company, to Yahoo stated finance.

Historically, households begin digging out of debt at first of a brand new 12 months, says Yahoo Finance.

“However that many years of development can disappear, not as a result of debtors are out of debt, however as a result of they now need assistance for his or her costly automotive loans and balloon debt all year long,” says Yahoo Finance.

Russell instructed Yahoo Finance {that a} automotive cost often shouldn’t soak up greater than 13-14% of the online earnings of a person, however that people at the moment use 21-22% of their automotive funds earnings.

“It is virtually 1 / 4 of your earnings that solely serves a automotive mortgage cost,” Russell stated within the article. “It is not sustainable.”

Russell additionally stated that time period lengths on the loans elevated to 78 months once they had been 48-60 months.

In line with the article, some automotive house owners after bank cards, on common, about 20%, turned to pay bills.

CCC Top 2024 Trends Report The common transaction value was $ 48,623 in October, whereas the typical new automobile financing charges had been up 7% over the previous two years.

About 17% of latest automotive loans have month-to-month funds of $ 1,000 or extra, barely dropped from 17.9% within the fourth quarter 2023. From Q3 2024, nonetheless, 24.2% of latest automobile gross sales had damaging with shoppers of their automotive loans , as a mean of $ 6.548.

Increased funds can lead to shoppers protecting their autos longer. From 2024, 66% of the autos are in operation seven years or older and the typical age of the US automobile has now risen to 12.6 years.

The report famous that the outdated automotive parcer may additionally imply that customers with older autos usually tend to enhance deductions or drop the primary celebration protection, which lowers coverage restrictions. The patron can even select to go utterly with out insurance coverage.

Mimic

Picture courtesy of Atakan/iStock

Graph with permission of the federal reserve

Share it:

Consequence

==================================================

AI GLOBAL INSURANCE UPDATES AND INFORMATION

AIGLOBALINSURANCE.COM

SUBSCRIBE FOR UPDATES!