Shoppers put their hearts on their sleeves, wrists, and various physique elements because of the present and rising wearable applied sciences. By an estimated $84 billion by 2022, wearables1, mixed with AI and its means to glean insights from an abundance of disparate information, give all times and annuity carriers a chance to deal with widespread strategic enterprise areas: development and prospects focus.2

The chance to deal with these strategic imperatives lies within the service’s means to stay related to policyholders by increasing the variety of contact factors through the moments that matter in a policyholder’s life. Accenture calls it “dwell providers.” If insurers maintain pace with evolving shopper expectations, these providers should be frictionless, hyper-personalized, and satisfying. Dwell providers and the convergence of well-being wealth allow life insurers to create new income streams from services outside of insurance coverage.

Turn out to be a “regular insurer” to win new prospects

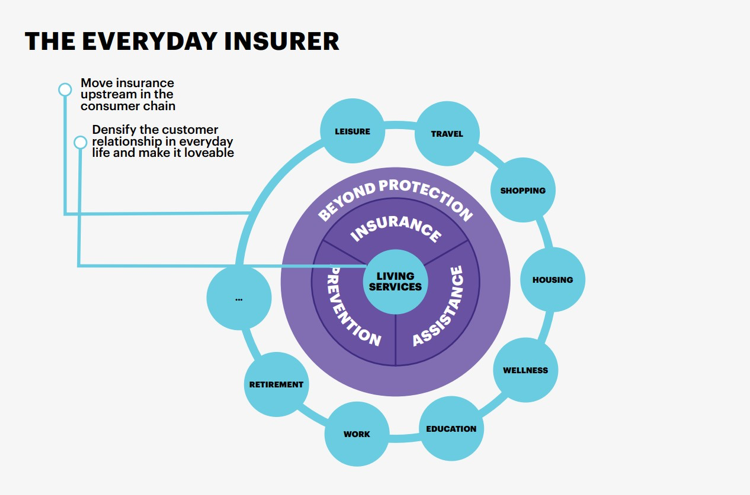

Just like the traces between life, well-being, and wealth safety fade, insurers should join upstream with CyouMarch and throughout the coverage life cycle through alliances and partnerships with complementary safeguards and prevention providers. The chart beneath identifies key contacts in a shopper’s life; it, with related partnerships, can provide new alternatives for insurers and their companions.

Take wellness, for instance. The insurance coverage business can enter many extra sources of third-social gathering well-being information—some in actual time-inclusive well-being scores and threat engines that allow underwriters to present even more correct worthing for a wider variety of discrete segments. Expertise exists right now that makes it doable to leverage wellness information to offer incentives for customers to enhance their common well-being and monetary well-being. In keeping with Gartner Inc., over the next two to 5 years, the business will increasingly shift toward proactive well-being monitoring, after which it will set its sights on interactive life/well-being administration. To get there, the analysis home claims, insurers might want to shift not solely their enterprise focus but in addition their digital and know-how focus.3

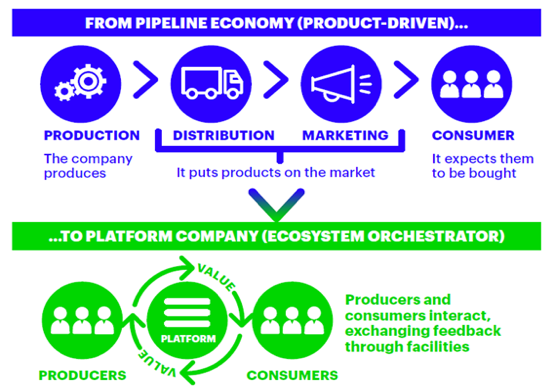

What is required to achieve the brand new world of related well-being and wealth is a digital insurance coverage technique that leverages Web of Issues (IoT) platforms and a mix of applied sciences, starting from hyper-personalization and clever enterprise to clever automation and predictive disruption. These applied sciences, built-in with a digital insurance coverage platform, allow more complicated interactions at scale than merely promoting insurance coverage and different services. This consumer-centric technique shifts the chance from promoting merchandise to delivering outcomes similar to higher well-being and wealth defense by lowering the threat for each.

Think about the John Hancock Vitality® program that rewards policyholders for wholesome dwelling and uses health trackers to confirm wholesome conduct. Policyholders in the Vitality program contact John Hancock virtually 600 times a year. John Hancock claims vitality prospects generate a 30 p.c. decrease in hospitalization prices than the remainder of the insured inhabitants. This system has also demonstrated its means of considerably cutting back on consumer morbidity and mortality charges. The intense involvement, together with a gradual circulation of rewards, constructs buyer loyalty and satisfaction. The wealth of information Vitality gives additionally allows the insurer to evaluate the dangers and worth of insurance coverage more precisely than carriers utilizing a coarser mixture of information, thus probably changing into extra aggressive and worthwhile. John Hancock has now built Vitality into his life insurance coverage insurance policies. (Supply: AccentTechnology Vision for Insurance 2019)

Insurers should shift to a collaborative digital enterprise model and join with customers where they’re digitally current and engaged, similar to with a health tracker, telehealth platform, or buying on an e-commerce platform. Via APIs, insurers join the digital insurance coverage platform to receive information from the health or e-commerce platform and vice versa. Then they apply AI to construct digital personas for particular persons at particular seconds in time, at which level they supply related recommendations. As these contact factors enhance over the policyholder’s life, insurers and producers alike deepen their relationship with the customer, which may result in a worthwhile new enterprise. The Accenture 2017 Global Distribution & Marketing Consumer Study discovered that customers ask for any such service and are prepared to pay extra for that. Within the research, 46 percent of customers indicated not solely that they might pay extra for customized, real-time providers but also that they have been prepared to share extra private information to get it.

Picture supply: Accenture Analysis primarily based on Accenture paper “Evolve to Thrive in Rising Insurance coverage Ecosystem”; Accenture Monetary Companies International Distribution and Advertising Shopper Survey, 2017

We consider that insurers that join well-being and wealth will achieve a major, aggressive benefit. The know-how exists right now to make the connection. Accenture helps carriers undertake a digital insurance coverage platform that seamlessly connects with many ecosystems to uncover worthwhile alternatives, unlock trapped worth, and breathe new life into life insurance coverage.

Learn the way Accenture may help your insurance coverage enterprise innovate and grow.

References:

- Gartner, Forecast: Wearable Electronic Devices, Worldwide, 2018 Alan Antin, Ranjit Atwal, Tuong Nguyen, 24 October 2018.

- Ibid

- Gartner: The convergence of life and health insurance requires interdependent ecosystems Richard Natale, Kimberly Harris-Ferrante, Bryan Cole, 22 Might 2018.

==================================================

AI GLOBAL INSURANCE UPDATES AND INFORMATION

AIGLOBALINSURANCE.COM

Subscribe for updates!