Central Provident Fund (CPF) contributions to platform employees might result in an annual price enhancement of around US$368 million, based on a report launched on Thursday (November 28) by marketing consultant Momentum Works. This apparently excludes different prices, equivalent to office damage compensation (WIC) insurance coverage, which is estimated to be US$32 million per year.

As for insurance coverage premiums, the report notes that it is an “enterprise dialogue” between the insurer and the respective platform operators.

This shall be at the discretion of the insurers and may be calculated as a share of the platform employees’ internet earnings or based on the variety of journeys.

The CPF contribution from platforms begins at 3.5% in 2025 and will increase by a further 3.5% per year to achieve the prevailing price of 17% by 2029 for employees born in or after 1995 or those who subscribe to the scheme.

The report mentioned that employees’ GPF contribution will begin at 12.1% in 2025 and can be enhanced till it reaches the prevailing price of 20%.

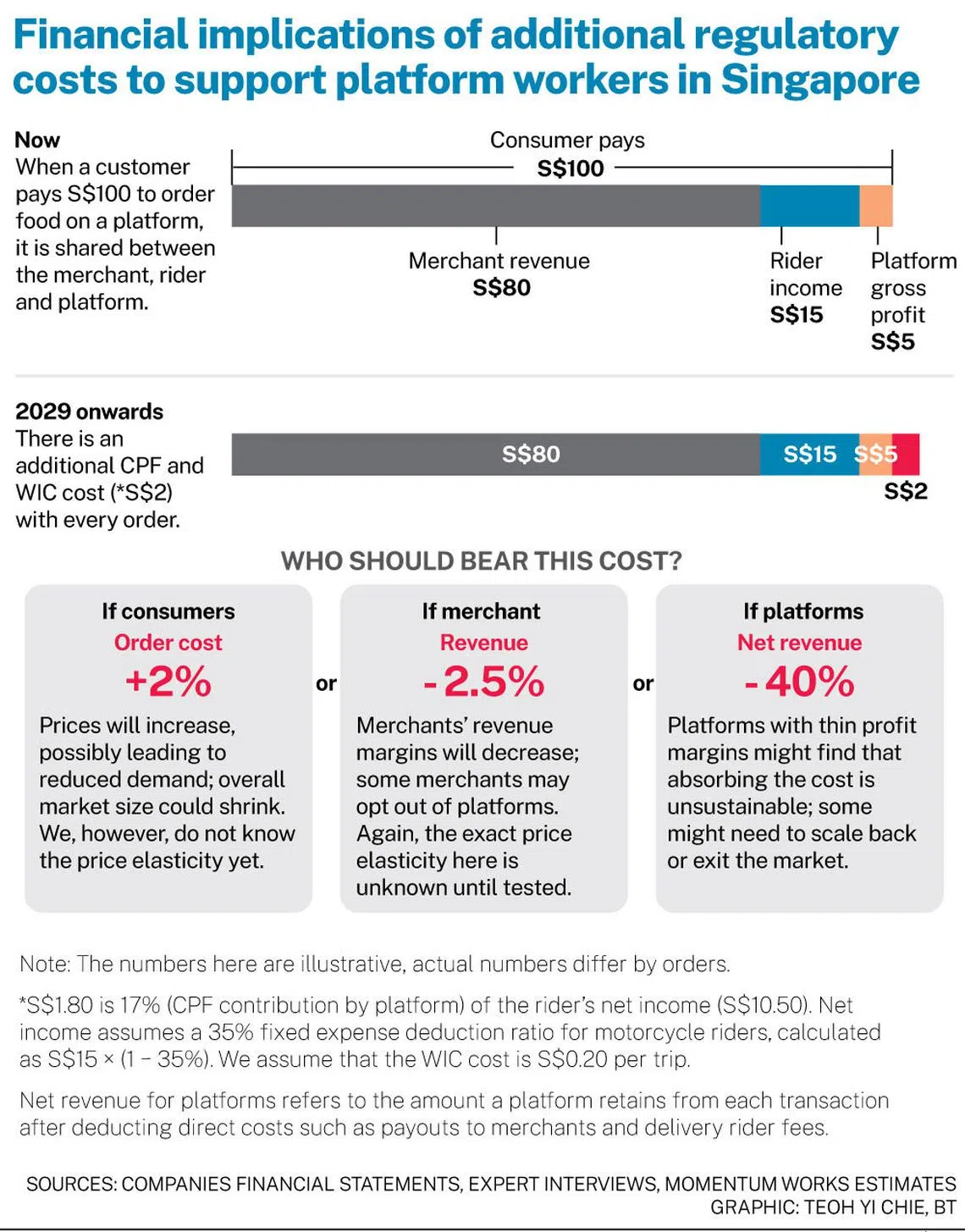

Earlier than the CPF contributions, a S$100 order would see riders get S$15 whereas platforms get S$5. After CPF contributions, a $100 order will lead to a further $2 being carved out to pay for CPF contributions.

BT in your inbox

Begin and finish every day with the most recent information and evaluation delivered straight to your inbox.

Momentum Works estimates that prospects would pay 2% extra if the CPF prices had been handed on to them. Merchants will see a 2.5% drop in income in the event that they need to pay for CPF costs. Platforms might see a 40% drop in income if the CPF prices had been absorbed by them.

The Platform Employees Invoice was introduced in Parliament in August this year, with the safety for platform employees in Singapore expected to kick in from 1 January 2025.

This was after a set of suggestions was accepted by the Advisory Committee on Platform Employees. Over the previous year, the committee has examined how Singapore ought to better defend this group of individuals. Platform employees have up to now been handled as self-employed individuals.

The adjustments will have an effect on greater than 73,000 platform employees, comprising 30,600 personal rent automobile drivers, 16,700 supply employees, and 26,300 taxi drivers. Nevertheless, the road lanes of taxis shall be excluded from the measures.

Commenting on the findings, Li Jianggan, founder and CEO of Momentum Works, mentioned: “We may even see costs for platform providers rise, which can initially dampen demand for his or her providers; however, finally elevated costs will raise the true price mirror of honest labor practices in the long run.”

He added: “With the numerous extra prices, platforms of all sizes might want to adapt their enterprise fashions going ahead.”

==================================================

AI GLOBAL INSURANCE UPDATES AND INFORMATION

AIGLOBALINSURANCE.COM

Subscribe for updates!