Profitable related wellness companies create vital worth for all times insurance coverage suppliers and their prospects.

Advances in digital know-how have positioned buyer relationships on the forefront of many organizations’ enterprise methods. Corporations throughout a wide range of industries are utilizing modern digital options to strengthen ties with prospects, thereby bettering retention, growing cross-selling and maximizing new enterprise alternatives.

Nevertheless, many life insurers have been reluctant to put money into these digital options. They noticed the standard hole between themselves and their prospects as too massive to be bridged by this rising know-how. Most prospects not often contact their life insurance coverage suppliers. In the event that they do, it is normally to query an account, replace a coverage or make a declare.

Now it appears to be like like this typically distant relationship is about to alter. Related wellness, together with comparable choices like related well being and a few types of telemedicine, presents carriers with a fantastic alternative to make use of digital know-how to domesticate a lot nearer ties with their policyholders. The advantages are prone to be substantial. For instance, we estimate that life insurers may earn US$16 billion to $24 billion in new income in mature markets by leveraging the rising demand for related companies utilizing wearables (wearable units). Such revenues will likely be derived from market sectors at present underserved by life insurers.

Related wellness companies join massive numbers of digital units, corresponding to wearables, sensors and cellphones, with subtle analytics programs to offer insurers with a continuing circulation of real-time buyer knowledge. Insurers use this knowledge, with their prospects’ consent, to encourage policyholders to steer more healthy and safer existence, thereby dwelling longer and claiming much less. Moreover, the big quantity of real-time buyer knowledge generated by related wellness companies permits insurers to considerably enhance their threat evaluation and pricing.

Life insurers may earn US$16 billion to $24 billion in new income by tapping into the burgeoning marketplace for related companies utilizing wearable units.

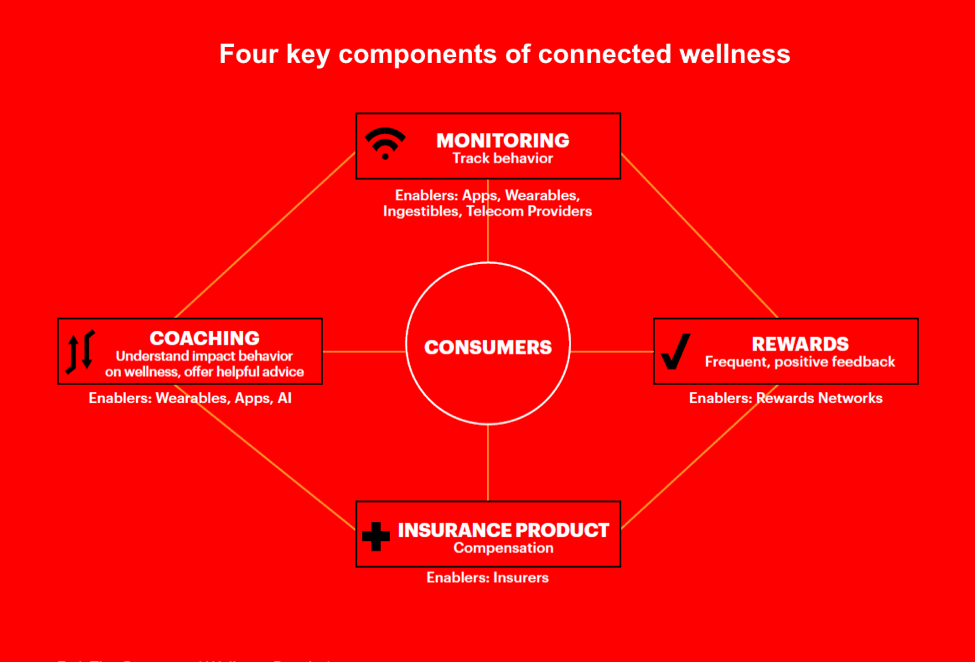

Profitable related wellness companies mix insurance coverage merchandise with monitoring purposes, which observe buyer habits, with teaching and reward applications to advertise wholesome existence (See diagram beneath). Along with such wellness choices, some insurers are contemplating offering supplemental companies, corresponding to telemedicine that present prospects with fast entry to medical care suppliers. The latest acquisition of American Properly, a Boston-based supplier of healthcare communications companies, by Allianz’s Allianz X enterprise capital fund is an instance of this technique.

Related wellness creates worth for each the client and the insurance coverage supplier. The shopper can profit from higher well being, larger security and quicker entry to care, in addition to get pleasure from a wide range of rewards and incentives. The insurance coverage supplier can cut back its prices, strengthen ties with policyholders and ship a wide range of new, probably worthwhile, related services and products.

Life insurers who don’t embrace related wellness threat being restricted to the wholesale insurance coverage enterprise. Lengthy-term alternatives to develop revenues and broaden operations on this sector are modest.

In my subsequent weblog submit, I’ll talk about how related wellness may also help life insurers rework their companies to allow them to make the most of the numerous alternatives rising within the digital economic system. Till then, try these hyperlinks. I am positive you may discover them worthwhile.

Connected Wellbeing: Life Insurance.

==================================================

AI GLOBAL INSURANCE UPDATES AND INFORMATION

AIGLOBALINSURANCE.COM

SUBSCRIBE FOR UPDATES!