Premium will increase in life and common insurance coverage will enhance the trade this 12 months.

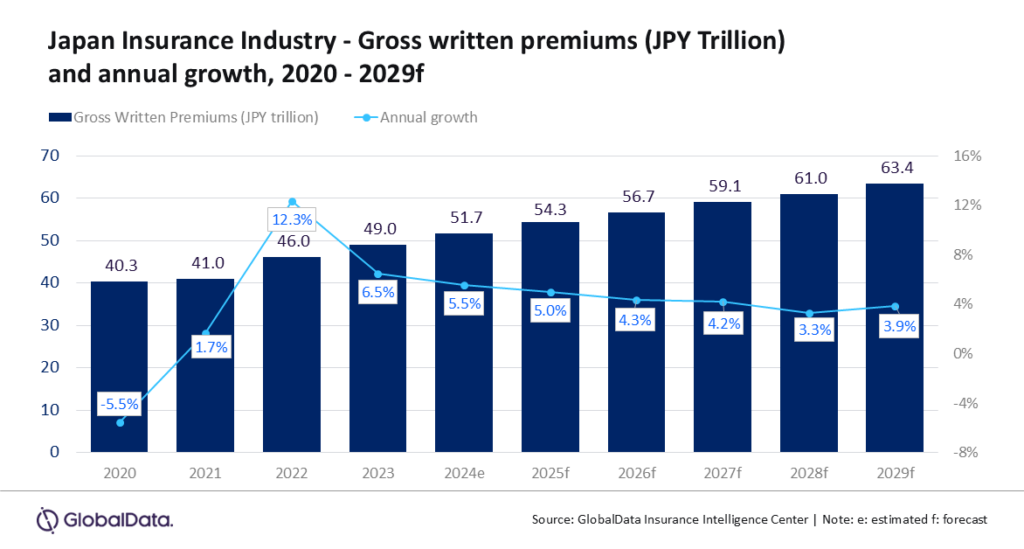

JapanThe insurance coverage sector is predicted to be greater than $ 470 billion in 4 years, and in accordance with the insured annual development price (CAGR) from 3.9% from 2025 to 2029, in accordance with Global data.

Life insurance coverage consists of 77.4% of Japan’s complete insurance coverage premiums in 2024, whereas common insurance coverage accounts for the remaining 22.6%.

World information attributes the projected development to demographic and regulatory adjustments, in addition to a larger demand for protection in opposition to pure catastrophes and cyber dangers.

The nation’s financial system is predicted to rally 0.9% in 2024, after a 1.9% growth in 2023, Swarup Kumar Sahoo, senior insurance coverage analyst at GlobalData, mentioned within the analysis observe.

Regardless of the anticipated slowdown, World information says a restoration in financial exercise, the rising demand for yen-denominated merchandise, and premium will increase in life and common insurance coverage segments in 2025.

The Japan’s life insurance coverage phase is predicted to develop by 5.9% in 2025. The query is pushed by an outdated inhabitants and the rising life expectancy.

Folks aged 65 and older made up 29.3% of the inhabitants in 2024, a determine anticipated to rise to 34.8% by 2040, in accordance with the Nationwide Institute of Inhabitants and Social Safety Analysis.

Regulatory adjustments additionally performed a task. In January 2024, the Monetary Providers Company moved to restrict the sale of international currency-denominated insurance coverage merchandise, which requested for a return to Yen-based gives.

Life insurance coverage is predicted to develop from a CAGR of 4.4% from 2024 to 2029.

The overall insurance coverage phase is predicted to develop at a 2.2% CAgr over the identical interval.

Development is supported by rising premium charges, elevated demand for wet-CAT protection and the next survey of accountability insurance coverage.

Nonetheless, the growth of the final insurance coverage sector is prone to be tempered by slower development in automobile insurance coverage, which represents nearly half of the phase premiums.

Sahoo additional notes that the rising frequency and severity of maximum climate occasions have led to increased calls for over the previous 12 months, which requested insurers to rethink danger publicity and enhance premium charges.

Since 2020, the Common Insurance coverage Assessment Group of Japan has usually elevated the nationwide common reference web price used to guide private fireplace insurance coverage premiums, reflecting increased funds for insurance coverage and restore prices.

Among the many common insurance coverage strains, legal responsibility insurance coverage is predicted to be the most important development in 2025, supported by the rising demand for cyber insurance coverage and employee compensation insurance policies.

==================================================

AI GLOBAL INSURANCE UPDATES AND INFORMATION

AIGLOBALINSURANCE.COM

SUBSCRIBE FOR UPDATES!